Afrimat: A quality quarry acquirer

Some scenario analysis before before evaluating the nitty-gritty output of this quarry operator

In this article:

Afrimat adds industrial minerals to its construction materials business

Forces in the external environment

Accounting for good and bad scenarios

FarSight’s appraisal of Afrimat’s value creation story

The bottom line

The November edition of Financial Mail’s Investors Monthly covers nearly a dozen companies, providing excellent analysis of each one’s prospects, and ending each article with their recommendations for whether to buy, hold or sell.

Amongst these articles is an analysis of Afrimat, by Anthony Clark. Not only is it a great read, but many of the insights accord with our FarSight appraisal, conducted a year earlier.

In this post, I’ve depicted the FarSight model across a series of graphs, and will reference both Clark’s article and FarSight’s analysis to provide a mental picture of how we can think about a company’s value creation story.

In my article, Build Value theFarSight Way - Part 2, I described how FarSight seeks to understand a company’s potential, and then determine and prioritise the company’s main value drivers and risks. We want to find out the clarity of the company’s Purpose, the strength of its financial and operating Systems, how positively it builds its Relationships, and the capability and trustworthiness of its Leadership.

Afrimat adds industrial minerals to its construction materials business

Step one, under ‘Discovering potential’, is to learn about the business. Back in 2006, when it listed on the JSE, Afrimat, according to Clark, started out in construction materials, a business highly exposed to the booms and busts of the business cycle. Since then, its strategy has been to smoothen the cyclical ups and downs by diversifying into complementary segments relating to its expertise in quarrying, but with exposure to a variety of markets, including iron-ore for export to China and to local steel smelter, ArcelorMittal. Its industrial minerals division is aimed at a variety of markets, from Agriculture to electric vehicle components. Most recently, Afrimat’s strategy focuses on developing advanced materials that it hopes will give it an edge in the blended cement industry.

Forces in the external environment

Step two is to understand the forces that arise from the external environment. To what extent will these forces lift the company up, or pull it down?

The first graphic, below, takes a look at the global environment. Cell A represents the global environment before the U.S. election. In this graphic, the blue bar above the line represents the global forces creating value, while the grey bar below the line represents the forces that could potentially destroy value. The small, positive arrow suggests that on net, the AI boom and falling interest rates slightly outweigh the threat of World War III, weak U.S. leadership and the energy crisis.

Note that all these graphs are pure conjecture, designed only to help illustrate scenarios, rather than pretend to be accurate quantitatively.

Cell B depicts how the world changed following the U.S. election. Now, while U.S. protectionism adds to potential value destruction, the threat of World War III is potentially diminished by a strong U.S. leadership, while the new administration appears likely to enact pro-business and pro-energy policies, all of which adds to business confidence and the willingness of entrepreneurs to invest in growing the economy. Indeed, global stock markets have reacted positively, in line with this picture.

Accounting for good and bad scenarios

Every year around this time, the Economist magazine makes a prediction for the following year and every year the editors are wildly wrong. Who could possibly foretell a pandemic, or the Russian invasion of the Ukraine? This is the value of scenario analysis. In Cell C, I have added an event for next year, a volcanic eruption (could be in Iceland, or Mt Etna, or somewhere in the U.S.) that casts a gigantic cloud over the northern hemisphere, dropping temperatures, ruining crop production and drastically limiting air travel. In this case, the negative bar is far larger than the positive bar, with a net negative outlook for business, at least in the short term.

The graphic below combines the global, post-U.S. election outlook with two SA scenarios. In cell D, a positive SA outlook, and in cell E, a negative SA outlook. If the Government of National Unity (GNU) works out and ambassador Ebrahim Rasool mends relations with the U.S., then the positive forces on the economy may provide a stronger value-creating environment for SA business than the negative forces. On the other hand, in cell E, former President Zuma’s MK party may continue to rise, the GNU could come apart, and the pro-business policies of SA’s partnership between government and business may fail. Indeed, interest rates are still relatively high, and should Transnet stay in limbo, organised crime continue to rise, and our alignment with the BRICS bloc continue to upset U.S. relations, the external forces in SA would be net negative, threatening to destroy value for local businesses.

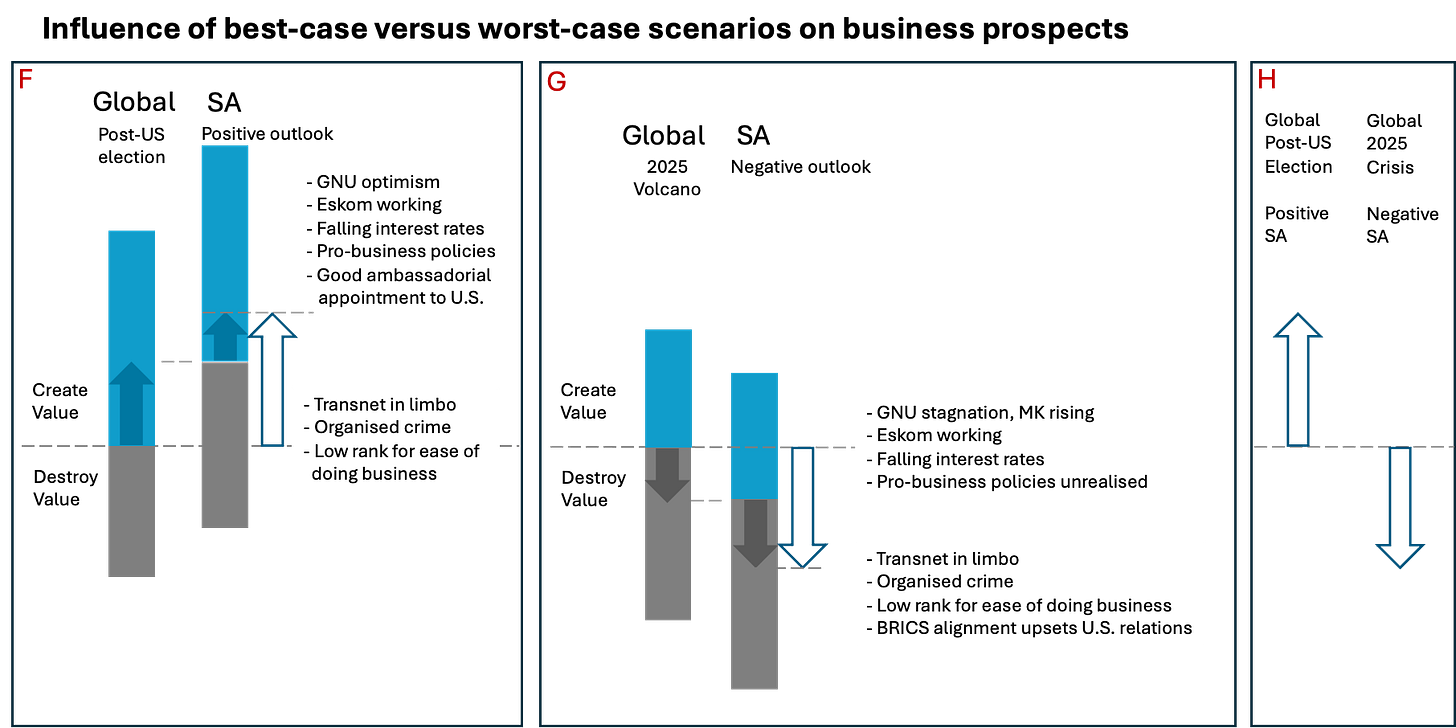

Cell F in the graphic below is the best case scenario, with both a positive outlook for the world combining with a positive outlook for SA, while cell G shows the worst case scenario, with a 2025 ‘volcano’ event severely dampening the global outlook, combined with a negative outlook for SA. Cell H shows the wide gap in outcomes separating these scenarios.

Modelling these scenarios is helpful when thinking about your investment portfolio and helps explain why bitcoin and gold are so sought after, even as the likes of the AI ‘spades and shovels’ stocks command such high valuations. It also illustrates why it is important that most of your portfolio should comprise widely diversified ETFs with a range of sectors and geographies that provide natural hedging effects (i.e. in a scenario where one sector is struggling, another may be profiting). It also illustrates the importance of ensuring that companies in your portfolio have sound finances, carrying little debt. Berkshire-Hathaway, for example, has been steadily adding to its pile of cash. This allows it to weather a possible future storm, as well as be in a position to buy companies distressed by a crisis.

Afrimat construction index informs the outlook for both economy and sector

Economist Dr Roelof Botha compiles the quarterly Afrimat Construction Index (ACI) of the level of activity within the SA building and construction sectors. Constituents to the index include: Wholesale Construction Trade, Employment in Construction, Building Materials (Volume), Retail Trade Sales, Construction Value Added, Salaries & Wages, Building Materials, Buildings Completed, and Building Plans Passed.

Of these nine constituents to the index, it is worth noting that leading indicators of Building materials sales, Salaries & wages and New jobs created rose significantly, while municipalities are improving, with increases in Building plans passed and Buildings completed at larger municipalities.

Highlights from Botha’s report:

Restrictive monetary policy has kept interest rates relatively high, but with hope that the cycle is turning

Inaugural national summit for crime-free construction sites held in November 2024

Other value drivers required to grow the sector:

Public/private partnerships gaining momentum to repair, maintain and expand the country’s logistics infrastructure

Progress constructing renewable energy infrastructure

Continued double-digit growth in new capital formation

FarSight’s appraisal of Afrimat’s value creation story

Clark’s story of Afrimat is generally in agreement with the FarSight model:

Clear Purpose: The company recognised it was exposed to the cyclicality of the construction industry and has focused on diversifying into adjacent lines of business, making strategic acquisitions along the way, most recently buying Lafarge Cement. The company’s strategy aims to provide Afrimat a competitive edge in the blended cement industry, while also profiting from the potential demand for minerals required for the transition to renewable energy technologies.

Sound financial and operating Systems: Afrimat has a solid reputation for being an excellent quarry operator, utilising its assets efficiently, and generally running a lean, low-debt balance sheet.

Positive Relationships: Afrimat has proven itself capable of integrating new acquisitions into its business successfully, while developing and maintaining a positive and co-operative corporate culture.

Capable and trusted Leadership: The CEO and top executives own 21 percent of the company, strongly incentivising behaviour in alignment with minority shareholders. Leadership is stable, with long tenure, and Clark notes their ability to allocate capital, run an efficient business, and “act as a collective when it comes to strategy and expansion.”

The rest of Clark’s article describes Afrimat’s journey since its IPO, its 2024 performance, and its prospects for the future. The graphic below illustrates his words in picture form:

The graphic above shows that Afrimat can benefit from the post-U.S. election uplift, the positive outlook for South Africa, as well as what this means for the industrial minerals and construction industry. From this positive starting point (the forces in the external environment), Afrimat’s potential is represented in the ‘2024 Potential’ stacked bar, with the actual outcome for 2024 slightly disappointing as a consequence of delays in regulatory approval of the Lafarge acquisition (which had a knock-on effect for debt costs), and a weaker-than-expected iron-ore price on weak demand from China.

The bottom line

Finally, Clark lists the positive forces potentially creating future value for Afrimat, including full incorporation of Lafarge, new blended cement technology, iron-ore price at least holding steady, with a boost from the Chinese government’s spending to boost its economy. Previously noted negative forces of debt costs and weak demand from China are thus less of an issue. FarSight’s appraisal of Afrimat’s report is generally positive, and we are confident that leadership has the capability to realise much of the potential upside, while mitigating risks on the downside. The company’s governance and long track-record speak to leadership’s reputation and alignment with your interests as a shareholder.